Foreign Currency Profit and Loss Calculation Summary Tool

Understanding the "Foreign Currency Profit and Loss Calculation Summary Tool"

Important Matters Concerning Foreign Currency Deposits

Your "Foreign Currency Profit and Loss Calculation Summary Tool" consists of three sections: "Unrealized profit/loss", "Realized profit/loss", and "Summary".

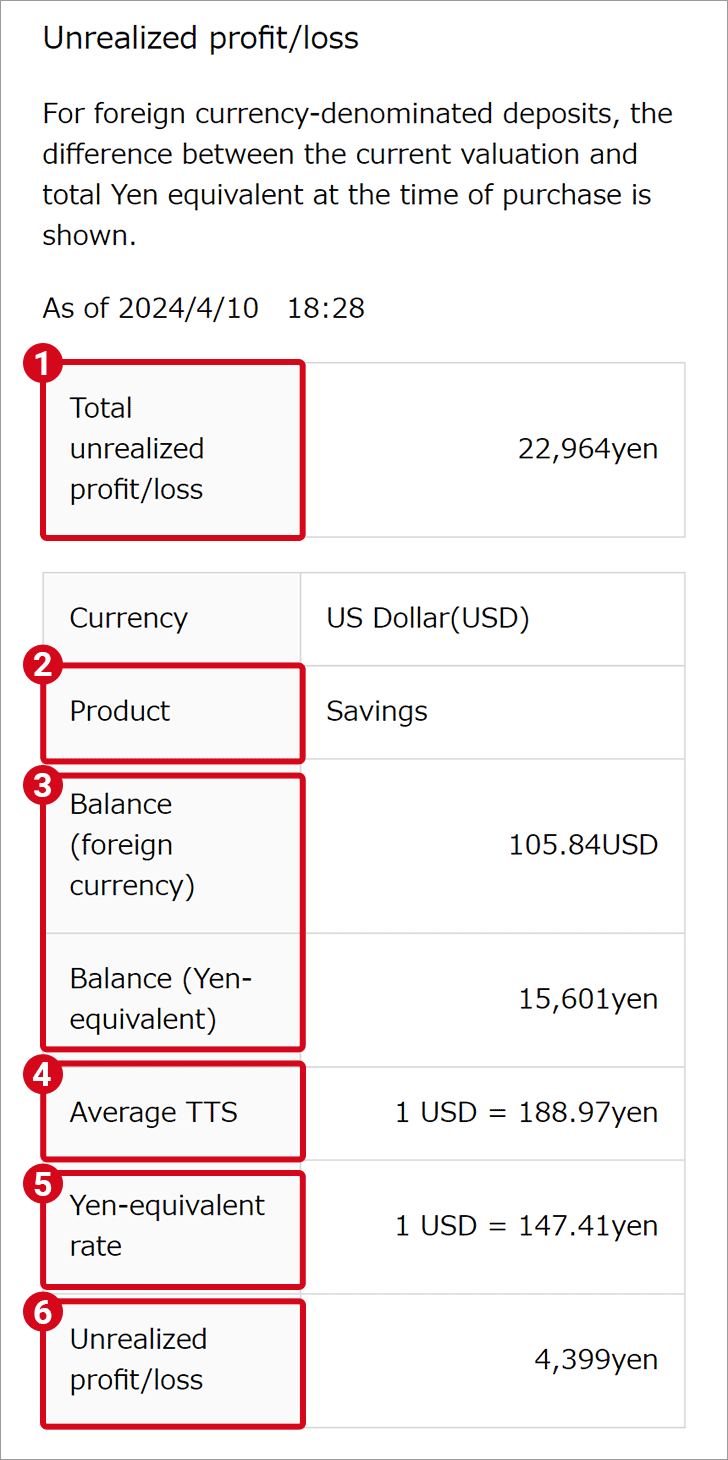

Unrealized profit/loss

You can check your unrealized profit/loss (the current valuation minus the total book value) for each product and currency related to your foreign currency-denominated deposits.

The unrealized profit/loss value only represents the value of a potential transaction converted at the current rate. Profits and losses are not realized unless you complete a transaction.

Unrealized profit/loss details

| List items | Description |

|---|---|

| (1)Total unrealized profit/loss | The total Yen-value of the unrealized profit/loss of your currently held foreign currency-denominated deposits. |

| (2)Deposit types | Savings: Foreign currency savings accounts Time deposit: Foreign currency time deposit (service only available in Japanese) Structured deposit: Currency-linked deposit (Foreign currency start type) (service only available in Japanese) |

| (3)Balance |

|

| (4)Average Purchase Rate | Average Yen-value required to purchase one unit of foreign currency as calculated by the calculation tool. |

| (5)Yen-equivalent rate | Sony Bank's exchange rate (TTB) is applied on the date and time displayed in the upper right corner of the screen.

|

| (6)Unrealized profit/loss | Unrealized profit/loss is equal to the Yen-equivalent of your balance minus the total book value. "Total book value" is the Yen amount required to purchase the foreign currencies you hold. |

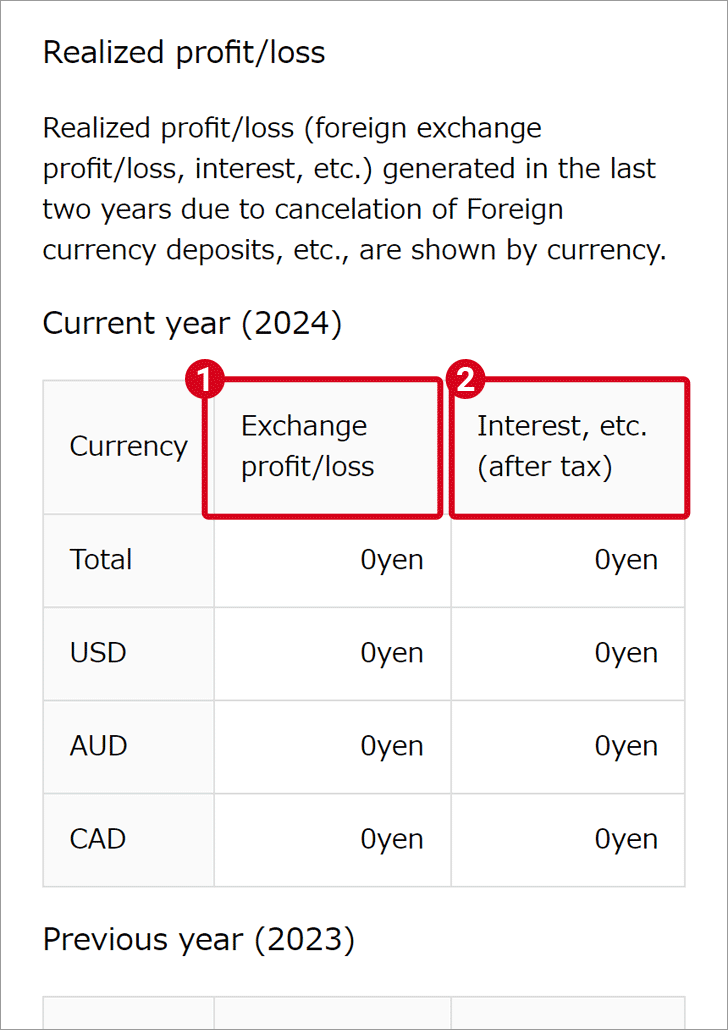

Realized profit/loss

A summary of your realized profit/loss (foreign exchange profit/loss, interest, etc.) for the last two years, is available. This summary displays all realized transactions on a per currency basis.

Realized profit/loss details

| List items | Description |

|---|---|

| (1)Foreign exchange profit/loss | Calculated foreign exchange profit/loss where the profit/loss was realized by sale, cancellation, etc. in the last two years. |

| (2)Interest, etc. (after tax) | Interest after tax (If you receive foreign currency, the amount is converted into Yen using the TTM of the relevant currency against Yen at the time of the interest payment.) |

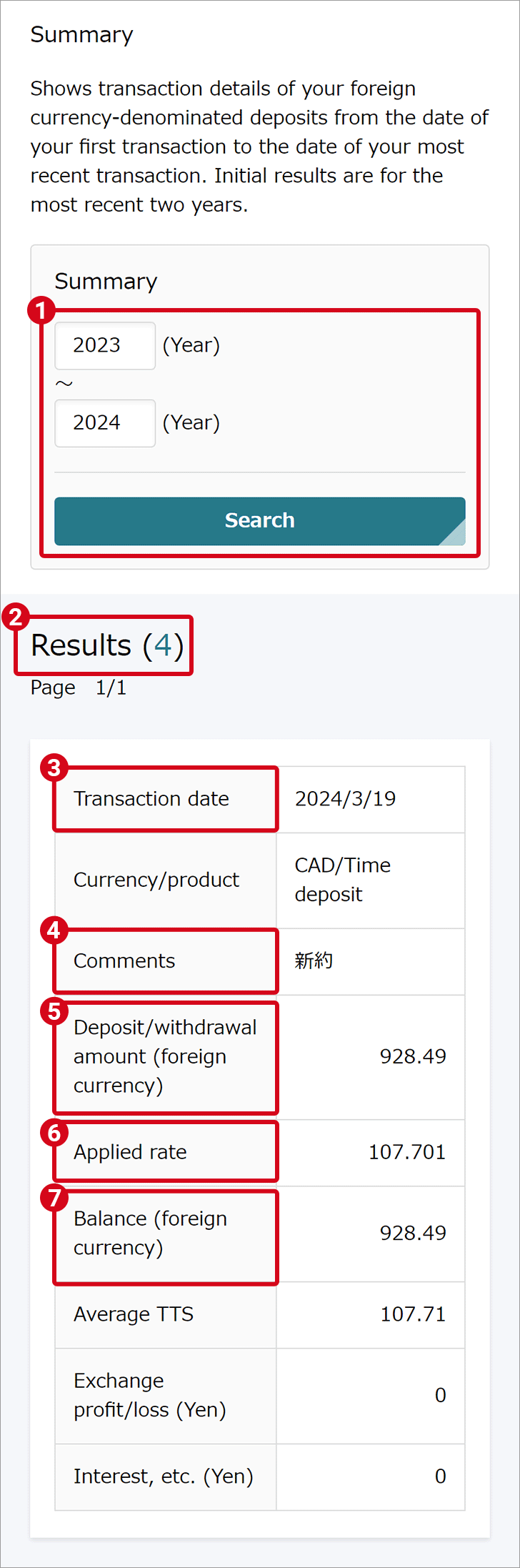

Summary

You can check all foreign currency deposit transaction details.

The previous two years are displayed by default. If you wish to browse for a different period, enter the year (4 digits) and select "Search".

Summary details

| List items | Description |

|---|---|

| (1)Period | The previous two years are displayed by default. If you want to change the displayed period of the transaction details, enter the year (4-digits) and select "Search". |

| (2)Results | Number of transactions during the specified period. |

| (3)Transaction date | Displayed in order of transaction date (oldest to newest). |

| (4)Comments | Your transaction details are displayed in Japanese. Interest and principal will be displayed separately from maturity and pre-cancelation details for the following products (only available in Japanese): Foreign currency time deposits Currency-linked deposits (Foreign currency start type) |

| (5)Deposit/withdrawal amount (foreign currency) | Deposits are displayed using a positive number. Withdrawals are displayed using a negative number. |

| (6)Rate | When a foreign exchange transaction is made, the actual TTS or TTB rate (or the preferential rate if you are a Club S member) applied is displayed. For non-foreign exchange transactions, the TTM at the time of the transaction is displayed. Applied rate details:

|

| (7)Balance (foreign currency) | Foreign currency balance of completed transactions. |