Corporate Information

Governance

Sony Bank is working to strengthen and enhance its corporate governance and internal controls in order to conduct sound and appropriate business operations to ensure consumer "security and safety" and to enhance its corporate value.

Corporate Governance & Internal Control

Board of Directors

The Board of Directors, consisting of eight directors, makes decisions on important corporate matters as a decision-making body, including the determination of management policies and important management decisions, and supervises the directors' execution of their duties. In principle, the meeting of the Board of Directors is held on a monthly basis.

Audit and Supervisory Board Members / Board of Statutory Auditors

Sony Bank has adopted a corporate auditor system, consisting of a four-member Board of Statutory Auditors. Each corporate auditor audits the directors' execution of duties by attending important meetings such as the Board of Directors meetings, the Executive Committee etc., and investigating the status of business and assets, in accordance with the board’s audit policy and audit plan.

Executive Committee

The Executive Committee is established under the Board of Directors as a decision-making body for the day-to-day execution of business operations, and makes decisions on important matters other than those to be discussed at Board of Directors meetings. In principle, the Executive Committee is held every week.

In addition, the ALM Committee, the Internal Control Committee, and the Risk Management Committee have been established as important committees for deliberations, reporting, and reporting to contribute to the decision-making of the Board of Directors and the Management Committee.

Internal Control

We have established and are operating an appropriate internal control system in accordance with the "Basic Policy for Establishment of Internal Control System" established by the Board of Directors in accordance with the Companies Act and the Companies Act Enforcement Regulations.

Internal Audits

In order to ensure the sound and appropriate operation of the banking business, our Internal Audit Department verifies the appropriateness and effectiveness of our internal control systems, including our risk management system. As an organization directly under the control of the President and CEO, the Internal Audit Department verifies and evaluates the effectiveness of internal control processes from an independent and objective standpoint, separated from the business execution lines, using auditing methods in accordance with the international standards of the Institute of Internal Auditors (IIA), and provides advice and suggestions for improvement as necessary. It also collaborates with the parent company's internal audit department to the extent that such collaboration does not conflict with laws and regulations.

The internal audit plan was formulated with the approval of the Board of Directors after identifying and recognizing operations and departments with higher risks. The Internal Audit Department conducts internal audits based on the internal audit plan and reports to the President and Representative Director, the Board of Directors, and corporate auditors. Additionally, the Internal Audit Department collaborates with corporate auditors and accounting auditors as appropriate.

The Institute of Internal Auditors (IIA) is an organization that plays a leadership role worldwide in internal auditing, focusing on the establishment of internal auditing as a profession and research on the theory and practice of internal auditing.

System for Compliance with Laws and Regulations (Compliance)

To maintain sound and appropriate business operations, it is necessary for each officer and employee to abide by the principles of Sony Bank, the expectations of Banking Laws and regulations, maintain high ethical standards, and conduct business operations in a transparent manner. At Sony Bank, we define this as compliance and regard it as one of the most important management issues.

To achieve compliance, we have compiled our corporate philosophy, action guidelines that apply to all our daily business activities, and laws and regulations that must be complied with into a Compliance Manual, which we disseminate to all officers and employees. The Compliance Program is formulated every year as a concrete action plan to achieve compliance and includes compliance-related training and awareness-raising activities, information collection and continuous review of the compliance system, as well as efforts to cut off relations with antisocial forces and prevent improper transactions.

In addition, Sony Bank has established internal and external contact points for the internal reporting system to collect compliance-related information in a timely and efficient manner, and to use this information to improve its legal compliance system, including the prevention of legal violations and their recurrence. From the viewpoint of enhancing the effectiveness of the system, we regularly evaluate the system operations and make improvements as necessary.

The Board of Directors oversees the operation of the Compliance Manual and Compliance Program through its formulation and approval and establishes a structure to ensure compliance.

Risk Management

Risk Management Basic Policy

To ensure the soundness and appropriateness of its operations, Sony Bank aims to improve profitability through sound risk-taking based on appropriate risk management. To this end, we believe it is necessary to recognize and identify risks that must be managed while conducting our business and manage them in an integrated manner under the supervision of the Board of Directors. This process creates a system that enables us to identify and manage various risks in a timely manner, allocate resources appropriately, and set profit targets.

Types of Risks

To further enhance risk management effectiveness, Sony Bank's Board of Directors has classified the risks to be managed into the following nine categories and has established management policies and systems: market risk, credit risk, liquidity risk, administrative risk, system risk, outsourcing risk, legal risk, reputational risk, and personnel risk.

In addition, the Risk Management Committee has been established to ensure the identification and management of all risks. The Risk Management Committee receives reports on the status of risk management from the departments in charge of each risk, deliberates on matters related to risk management, submits the results of its deliberations to the Executive Committee, and reports periodically to the Board of Directors.

In cases where risk management is required due to the launch of new products or operations, or changes in the internal or external environment, the Risk Management Department will add the relevant risk type to be managed.

Market Risk

Market risk refers to the risk of incurring losses due to changes in the value of assets and liabilities (including off-balance sheet assets and liabilities) due to fluctuations in interest rates and exchange rates, as well as the risk of incurring losses due to changes in earnings generated from assets and liabilities. In market risk management, to ensure mutual checks and balances, we have established a front office, a middle office, and a back office, and integrate financial transactions with the market (money, foreign exchange, bonds, and derivatives) and deposit and loan transactions with customers, calculating transaction gains and losses and the amount of market risk daily. The amount of market risk for the company is managed centrally using the Value at Risk. We also calculate interest rate sensitivity and foreign exchange sensitivity daily, and conduct stress tests on a monthly basis.

Credit Risk

Sony Bank's credit risk consists of "personal credit risk" associated with loans to individuals and "corporate credit risk" associated with market-related transactions and loans to corporations.

Personal Credit Risk

Personal credit risk refers to the risk of loss due to a decrease in or disappearance of the value of assets related to personal credit due to deterioration in the financial condition of the borrower. Sony Bank makes credit decisions on mortgages and card loans based on repayment capacity and cash flow. In addition, Sony Bank obtains real estate collateral for mortgages to improve the soundness of assets and reduce risk.

Corporate Credit Risk

"Corporate credit risk" consists of "market credit risk" associated with market-related transactions and "company credit risk" associated with loans to corporations. "Market credit risk" is the risk of incurring losses due to fluctuations in the market value of securities as a result of changes in the creditworthiness of the issuers of securities held by Sony Bank, and the risk of incurring losses due to non-performance of contracts in market transactions as a result of deterioration in the financial condition of the counterparties. "Company credit risk" refers to the risk that Sony Bank may incur losses due to a decrease or loss in the value of assets related to credit extended by corporate customers to whom Sony Bank extends credit, such as loans and acceptances of payment, as a result of deterioration in their financial condition. Sony Bank assigns common debtor ratings to its securities holding and market transaction counterparties and corporate loan counterparties, and manages credit limits according to the creditworthiness of the counterparties. In addition, Sony Bank manages the credit risk of all of these counterparties by setting limits of risks based on the expected maximum loss (Value at Risk).

Liquidity Risk

There are two types of liquidity risks: cash management risk and market liquidity risk

Cash Flow Risk

Cash flow risk refers to the risk of incurring losses due to the inability to secure the necessary funds on the settlement date, resulting in the inability to make payments, or being forced to procure funds at significantly higher interest rates than usual. Sony Bank establishes management methods, reporting methods, etc., depending on the degree of funding constraints, and sets and reviews guidelines as necessary.

Market Liquidity Risk

Market liquidity risk refers to the risk of incurring losses due to the inability to trade in the market due to market turmoil, etc., making it impossible for Sony Bank to close out its positions or be forced to trade at a significantly disadvantageous price than usual. Sony Bank monitors the market liquidity situation for the various products it handles and establishes and reviews guidelines for each product as necessary.

Administrative Risk

Administrative risk refers to the risk of tangible or intangible losses due to negligence, fraud, or other problems related to administrative failures. Sony Bank strives to minimize the occurrence of administrative risk by introducing risk management methods tailored to the location and nature of administrative risk through the review of workflows and analysis of relevant data. Sony Bank also strives to identify administrative risks in day-to-day business operations in a timely and integrated manner, and to formulate, promote and follow up on effective countermeasures.

System Risk

System risk refers to the risk of losses due to system-related accidents, damage, unauthorized use, or information leakage. Sony Bank analyzes and evaluates the location and nature of specific system-related risks in its operations and transactions and strives to minimize these risks by taking appropriate measures, including reviewing operational procedures and the system itself, as well as improving its risk management methods.

Business Outsourcing Risk

Outsourcing risk refers to the risk of incurring losses due to inappropriate business or information management by an outsourcing partner or difficulties in continuing an outsourcing contract. Sony Bank analyzes and evaluates the location and nature of specific risks in its operations and transactions and strives to minimize such risks by taking appropriate measures, including reviewing operational procedures, and improving risk management methods.

Legal Risk

Legal risk refers to the risk of losses incurred due to non-compliance with laws and regulations that Sony Bank must observe in the course of its business. The departments in charge of business operations and the Compliance Department work together to verify and confirm legal risks related to contract negotiations, business operations, transactions, and products. In addition, the Operations Management Dept. Financial Crime Risk Control Department manages risks related to Anti-Social Force and unauthorized transactions.

Reputational Risk

Reputational risk refers to the risk that Sony Bank's reputation in the marketplace and with its customers may be damaged due to unethical behavior, unfair transactions, or inappropriate information disclosure. In addition to business operations and transactions, Sony Bank identifies and analyzes reputational risk in media reports, etc., and discloses information in a timely and appropriate manner to ensure the reliability of the market and customers.

Human Resource Risk

Human resource risk refers to the risk that the company will incur damages or losses due to unfairness, inequity, or discrimination in human resources management. The department in charge of business operations and the Human Resources & General Affairs Department work together to provide education and guidance to employees, etc., as well as to disseminate and maintain internal regulations such as employment rules, to strengthen the system to prevent such human resource risks.

Others (Risk Mitigation and BCP)

Sony Bank's business performance, as well as the risk of the parent company's control impairing Sony Bank's management independence, Sony Bank has established a basic policy on risk mitigation and a system to ensure the independence of the bank's management and the soundness of its operations.

We also consider the business conditions of the parent company and maintain arm's length in transactions with the parent company group.

Additionally, a contingency plan has been established in consideration of the impact on customer transactions and socioeconomic activities, as well as the severity of economic losses incurred by Sony Bank in the event its business activities are suspended due to a disaster or other event.

Sony Group Inc. is the parent company involved in this risk management.

Personal Information Protection and Information Security

Protection of Personal Information

As a bank and a Sony Group member, Sony Bank places the utmost priority on earning and maintaining customer trust. Regarding the protection of customers’ personal information, Sony Bank carefully complies with related laws and ordinances, the guidelines of Japan’s Personal Information Protection Commission and other relevant authorities and business organizations, and the Sony Bank's privacy policy.

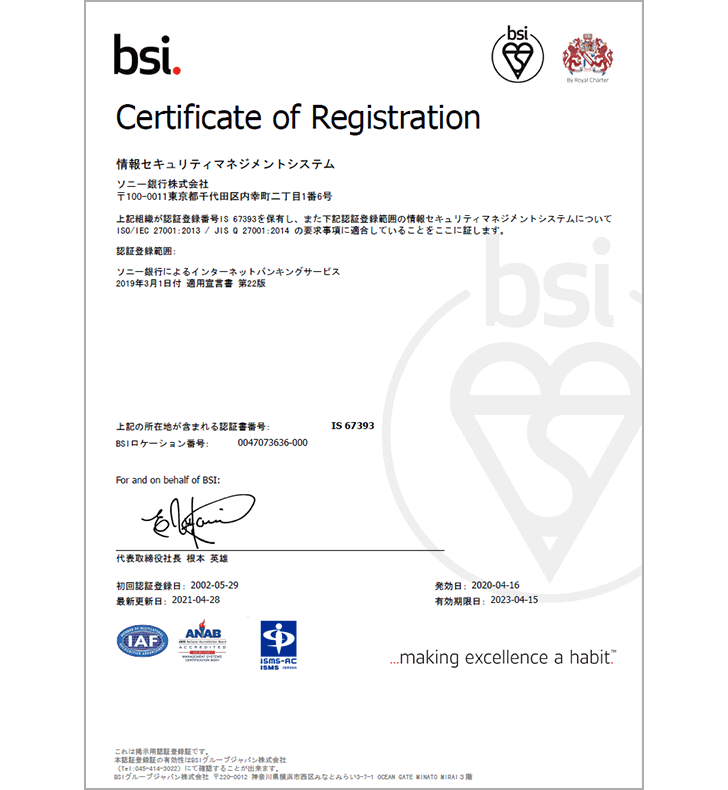

Information Security

As a bank that handles highly confidential information and uses open networks such as the Internet, Sony Bank recognizes the importance of information security management.

In May 2002, we obtained BS7799-Part2 certification, which is recognized as a global standard for information security management, and in August of the same year, we also obtained ISMS certification standards. In October 2005, BS7799-Part2 was made an ISO standard, and in May 2006, the ISMS certification standard was made a JIS standard. Sony Bank migrated to ISO/IEC 27001:2005 in April 2006, JIS Q 27001:2006 in June 2006, and ISO/IEC 27001:2013 and JIS Q 27001:2014 in April 2015, and ISO/IEC 27001:2022 and JIS Q 27001:2023 in April 2024.

We will continue our efforts to maintain and improve our information security.

Customer-Oriented Business Operation Policy

In order to provide high quality financial services in accordance with our corporate philosophy of fairness, Sony Bank has established a set of behavioral guidelines that apply to all executives and employees. Additionally, in an effort to realize more customer-oriented business operations, we have established a "Customer-oriented Business Operation Policy" as an action plan to put the action guidelines into practice.

The status of the action plan and voluntary KPIs are disclosed on our website.

- Customer-Oriented Business Operation Policy

- Disclosure of the status of initiatives related to the action plan of the "Customer-oriented Business Operation Policy" and voluntary and common KPIs (Available only in Japanese)

- Common KPIs (Available only in Japanese)

- Important Bank Information Sheet (Financial Institutions)